Identifying and Trading Harmonic Butterfly Patterns

Technical analysis is a commonly used tool by traders to analyze the market and identify potential price movements. Traders utilize various trading patterns and signals to interpret market trends. One such pattern is the harmonic butterfly pattern, which is employed in technical analysis to identify turning points in the market through a five-point reversal chart pattern.

This article provides an overview of the harmonic butterfly pattern, including how to trade it, accurately identify it, and important considerations when using this pattern.

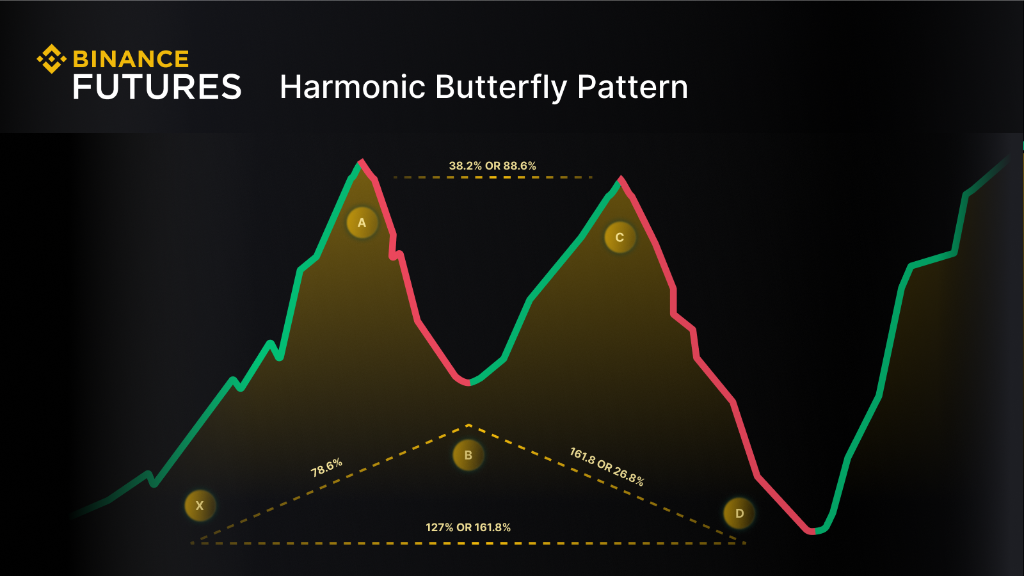

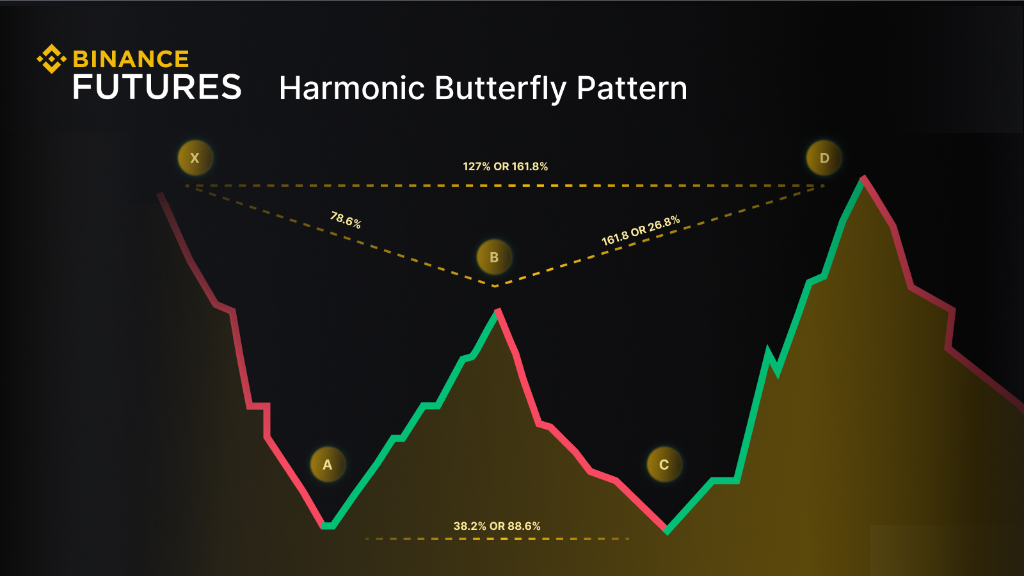

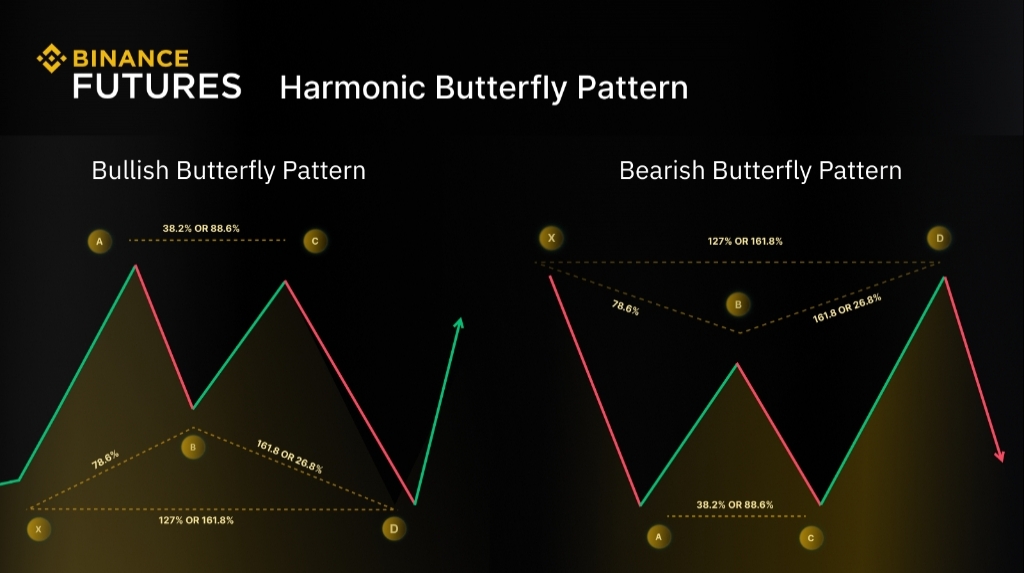

Understanding the Harmonic Butterfly Pattern The harmonic butterfly pattern is a retracement pattern that traders use to identify possible trend reversals. It consists of five points labeled X, A, B, C, and D. These points are connected to form four waves: XA, AB, BC, and CD.

The pattern resembles the wings of a butterfly and can appear in both uptrends and downtrends. Accurately identifying the pattern involves utilizing the Fibonacci sequence, which creates ratios of 0.618 and 1.618.

Identifying a Harmonic Butterfly Pattern When a formation resembling a harmonic butterfly pattern appears, trend lines can be drawn to aid in chart analysis and pattern visualization.

For a bullish harmonic butterfly pattern, the asset's price touches five different points, forming a four-wave pattern that resembles the letter M:

- The price moves upward from point X to A (XA wave).

- It retraces from point A to B (AB wave).

- An uptrend occurs from point B to C (BC wave), with point C slightly lower than point A.

- Finally, another downtrend occurs from C to D (CD wave).

Additionally, point C typically retraces to Fibonacci levels of either 38.2% or 88.6% relative to the AB leg. The harmonic butterfly pattern is formed when the upward move to point C corrects to point D, which is below point X. Point D becomes the new swing low and can be measured as an extension of the length of XA by a factor of 1.27. Once there is a reversal from point D, accompanied by increased buying volume, the pattern is considered complete, indicating a potential market rally.

It's important to note that the Fibonacci retracement level serves as a target range, and prices may not reach the exact price levels.

Conversely, a bearish harmonic butterfly pattern would resemble the letter W. The four-wave pattern starts at point X and corrects to point A (XA wave). The price then moves up from point A to B (AB wave), usually retracing 78.6% of the XA wave correction. Point B to point C is another retracement, but since it is the second correction, it is typically not as strong as the first downtrend (XA). Typically, point C will be slightly lower than point A. Finally, the CD wave consists of another upward move, and point D can be measured as an extension of the length of XA by a factor of 1.27.

Trading the Harmonic Butterfly Pattern

Identify the pattern: Begin by identifying the harmonic butterfly pattern in the cryptocurrency market, focusing on the five points: X, A, B, C, and D. This will determine whether the pattern is bullish or bearish.

Define your entry point: For a bullish harmonic butterfly pattern, consider trading a breakout by placing an order after a reversal when the price breaks above point D. For the bearish pattern, it would be the opposite—when the price breaks below point D.

Define your stop loss: Place a stop loss order below point X to limit potential losses in case the pattern fails.

Define your exit: Traders often set a take-profit order around point A or point B, where the price is likely to encounter resistance.

Accurately Defining the Harmonic Butterfly Pattern Accurately defining the harmonic butterfly pattern requires ensuring that the five points (X, A, B, C, and D) meet the mentioned criteria. Traders should also consider Fibonacci ratios as an overall guideline for forming the pattern. Combining the harmonic butterfly pattern with other technical analysis tools such as trading volume can help confirm potential breakouts or reversals. Traders should consider the overall market trend and various market factors before trading the pattern.

Closing Thoughts

Trading the harmonic butterfly pattern carries risks, similar to any other trading strategy or technical analysis pattern. Traders must accurately identify the pattern and employ proper risk management strategies, including the use of stop-loss orders. It's essential to consider the associated risks and exercise patience when waiting for the pattern to complete.

Each trader should consider their financial objectives and risk tolerance when deciding whether to trade the harmonic butterfly pattern. Conducting an independent assessment to determine if this trading strategy aligns with their personal financial goals and profile can be beneficial. It's also crucial to understand and accept the risks associated with such a strategy before engaging in trading. A comprehensive evaluation can assist traders in making well-informed decisions about their participation in the market.

Risk Warning: This content is provided on an "as is" basis for general information and educational purposes only, without any representation or warranty of any kind. It should not be construed as financial or investment advice, nor does it recommend the purchase of any specific product or service. Digital asset prices can be volatile, and the value of your investment may go down or up, with no guarantee of recovering the amount invested. You are solely responsible for your investment decisions, and Binance is not liable for any losses you may incur. For more information, please refer to our Terms of Use and Risk Warning.

The products and services mentioned herein may be subject to restrictions in certain jurisdictions or regions or may only be available to specific users in compliance with applicable legal and regulatory requirements. It is your responsibility to familiarize yourself with and comply with any restrictions and requirements regarding the access to and use of any products and services offered by or available through Binance in each country or region from which you access them. Binance reserves the right to change, modify, or impose additional restrictions on the access to and use of any products and/or services offered, at any time and without notice, in its sole discretion.

Source: Binance